TSC issues circular directs teachers and secretariat to take action

The Teachers Service Commission (TSC) instructed all employees via a circular to file their individual income tax returns for the year 2020.

The circular is dated 15th April 2020 and is addressed to Secretariat, Principals of Secondary Schools and Teacher Training Colleges, Directors of Cemastea, Kenya Institute of Special Education and Kenya Institute of the Blind as well as Head Teachers of Primary Schools. The Commission said that it has already uploaded P9 forms on its payslip portal for all employees to download and file returns on time.

Teachers and the secretariat staff now have until 30th June 2021 to complete filing their returns to avoid KRA penalties.

The Kenya Revenue Authority imposes a fine of Ksh. 2,000 for employees who do not file their returns on time for a year.

The Teachers Service Commission told its employees to file returns through KRA’s online platform via link https://itax.kra.go.ke

The commission also said it is working together with the Kenya Revenue Authority to update the tax records for the years 2015 to 2020 to facilitate the issuance of Tax Compliance and Clearance Certificates.

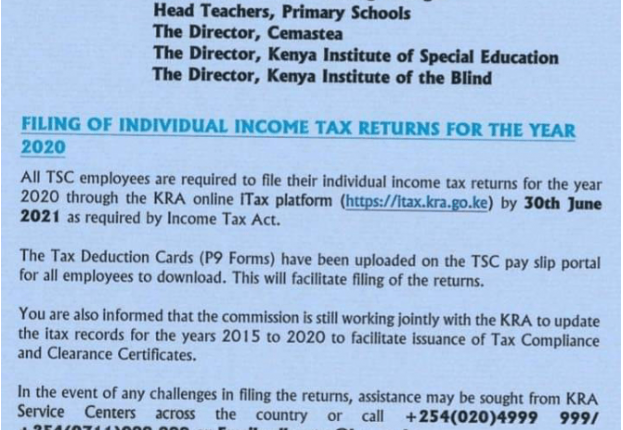

The Circular issued is as shown below.

Ref. No: TSC/AMD/192A/VOL.IX/101

Date: 15th April 2021

CIRCULAR NO: 5/2021

TO ALL:

Secretariat Staff

Principals, Secondary Schools

Principals, Teacher Training Colleges

Head Teachers, Primary Schools

The Director, Cemastea

The Director, Kenya Institute of Special Education

The Director, Kenya Institute of the Blind

FILING OF INDIVIDUAL INCOME TAX RETURNS FOR THE YEAR 2020

All TSC employees are required to file their individual income tax returns for the year 2020 through the KRA online ITAX platform (https://itax.kra.go.ke) by 30th June 2021 as required by Income Tax Act.

The Tax Deduction CARDS (P9 Forms) have been uploaded on the TSC payslip portal for all employees to download. This will facilitate the filing of the returns.

You are also informed that the commission is still working jointly with the KRA to update the Itax records for the years 2015 to 2020 to facilitate the issuance of Tax Compliance and Clearance Certificates.

In the event of any challenges in filling the returns, assistance may be sought from KRA Service Centres across the country or call +254(020)4999 999/ +254(0711)099 999 or Email:callcentre@kra.go.ke

DR. NANCY NJERI MACHARIA, CBS

SECRETARY/CHIEF EXECUTIVE

Comments are closed.