Heads of institutions to Report on Non-Compliance in Wealth Declaration

The Teachers Service Commission (TSC) has directed Heads of Institutions to report on those teachers who will not have declared their wealth by 31st December 2021.

Besides the Commission has also revealed two crucial requirements that are required when declaring wealth. Teachers just like other public officers are required to declare their Income, Assets and Liabilities (IALs) every biannual. The last time teachers declared their wealth was in 2019.

The requirement to declare wealth is stipulated in Sections 26 and 27 of the Public Officer Ethics Act (POEA).

TSC Circular 12/2021 dated on 4th October 2021 addressed to all Heads of Institutions and teachers and copied to Regional and County directors directed teachers to declare their wealth by the end of this year, that is, by 31st of December 2021.

However, with it being expected that some teachers might still miss out deliberately, the Commission has since warned all concerned that there will be consequences for non-compliance.

Besides, the TSC Chief Executive Officer (CEO) Dr Nancy Macharia revealed that teachers who will be culpable of non-compliance will face disciplinary action from the Commission’s administration as provided for in the TSC Administrative Procedures on the Declaration of Income, Assets and Liabilities (DIALs).

“Any teacher who fails to submit their wealth declaration or gives false of misleading information will be fined Sh. 1,000,000 or be imprisoned for a period not exceeding one year or both upon conviction,” said TSC CEO Dr Nancy Macharia.

Teachers on leave of any kind, on interdiction, suspension or authorized absence of duty together with those on duty are all required to declare Income, Assets and Liabilities.

For teachers who have never declared their wealth before mainly because they have been in employment for a period less than two years, the Commission has revealed that they should submit their ‘Initial declarations’. This is because the system has not yet been modified to accept the particular individual cases for those declaring their initial declarations.

TSC also sent bulk SMS to all teachers on the 3rd of November 2021 informing them that even the Wealth declaration exercise is going on and directing those who are yet to declare their wealth to proceed swiftly and do so.

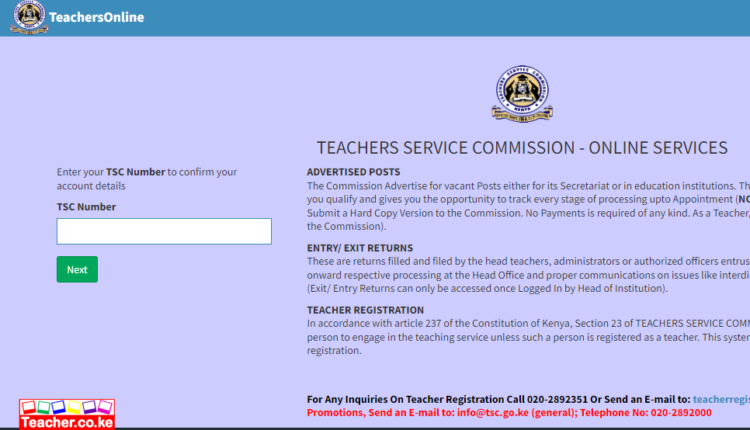

However, TSC has informed teachers that they must have an active official email address created from the portal that the Commission provided. Emails that were created on the portal end with @mwalimu.tsc.go.ke. However, some teachers did not create those emails and will now be required to do the same in order to be able to declare their wealth.

Besides the above, a teacher who is declaring their wealth will need either a smartphone or a computer or a laptop to be able to do so.

Teachers have been urged to provide accurate information when declaring their wealth and to ensure they have received an email of the duly filled declaration in their email which will act as confirmation of a successful Wealth Declaration Submission.

With TSC having migrated their operations online except in a few special cases where physical files will be required, the Wealth declaration process will be entirely online and no physical files or hard copies will be required.

Comments are closed.